$850 Million in Capital Targets Bladder Cancer Therapy Candidate

ImmunityBio, Inc. announced today a recent capital raise that provides significant financial resources to accelerate the Company's commercialization efforts and expand its pipeline within the broader urological cancer space.

The Company's pipeline is based on broad immunotherapy and cell therapy platforms designed to attack cancer and infectious pathogens by activating the innate and adaptive branches of the immune system in an orchestrated manner.

On January 2, 2023, the Company confirmed up to $320 million royalty financing and equity investment by Oberland Capital, with $210 million of gross proceeds received at closing on December 29, 2023.

The proceeds will also fund ongoing business operations and clinical trials expanding Anktiva® (N-803) indications into multiple solid tumors.

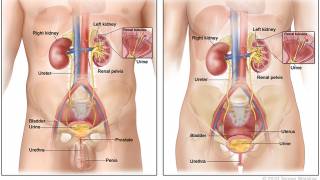

ImmunityBio's commercialization efforts are in anticipation of potential U.S. Food and Drug Administration ("FDA") approval of Anktiva in combination with Merck's Bacillus Calmette-Guérin (BCG) vaccine for the treatment of patients with BCG-unresponsive non-muscle invasive bladder cancer (NMIBC) with carcinoma in situ with or without Ta or T1 disease.

The Company announced on March 26, 2023, that the FDA had set a user fee goal date for Anktiva's Biologics License Application resubmission of April 23, 2024.

Anktiva® (N-803) is an investigational therapy, and no safety or efficacy has been established by any Health Authority or Agency, including the FDA.

"This transaction raises significant capital for the Company to support important growth plans, yet with limited equity dilution and with a cap on total payments tied to the initial investment," said Richard Adcock, Chief Executive Officer and President of ImmunityBio, in a press release.

"Besides providing a capital source at a key inflection point for ImmunityBio, this investment demonstrates strong confidence by Oberland Capital in our future, and in particular in the potential value of Anktiva in bladder cancer, as well as the direction of our clinical pipeline."

In aggregate, $850 million in capital was raised in 2023, with $320 million from institutional investors and $530 million from its founder, Patrick Soon-Shiong, M.D.

The investment from Oberland Capital takes the form of a $300 million Revenue Interest Purchase Agreement ("RIPA") that is non-dilutive to current investors, of which $200 million was funded at closing, and $100 million is to be funded contingent upon FDA approval of the Company's BLA for Anktiva in combination with BCG for NMIBC, and subject to other terms and conditions as outlined in the RIPA.

Under the terms of the RIPA, Oberland Capital will have a right to receive initially tiered single-digit royalty payments on net sales of the Company's products, which are capped at a multiple of their investment. In addition, the Company has entered into a purchase agreement with Oberland Capital for the private placement of 2,432,894 shares issued at closing, representing $10 million of gross proceeds based on the trailing 30-trading days VWAP. Oberland Capital can also purchase an additional $10 million of common stock at a future date.

In connection with the RIPA, the Company and Nant Capital entered into amendments to extend the maturity dates of certain existing promissory notes with an aggregate principal amount of approximately $505 million from December 31, 2024, to December 31, 2025, and to allow Nant Capital to convert up to an aggregate of $380 million of principal, plus accrued and unpaid interest, into shares of common stock at a price per share equal to a 75% premium to the closing market price on January 3, 2024. Nant Capital and the RIPA Purchaser Agent also concurrently entered into a Subordination Agreement, pursuant to which the Notes were subordinated to the Company's obligaCompany'sthe Purchasers under the RIPA.

Our Trust Standards: Medical Advisory Committee